Online Banking

Online Banking

Wealth Management

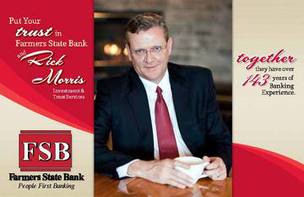

https://www.fsbanking.com/personal-sammonsThe FSB Trust and Investment Management Group has been a part of Farmers State Bank since 1940. There are a number of services that are provided through the trust department. If you would like additional information on how these products would work for you, give us a call at 1-877-394-0164 for a complete evaluation of your situation.

Insurance and Investment products are:

NOT A DEPOSIT

-

NOT FDIC-INSURED

-

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

-

NOT GUARANTEED BY THE BANK

MAY GO DOWN IN VALUE

Financial Services

Investment Management Services

Managing your investment portfolio can be a stressful and time-consuming process. Establishing an Investment Management account with Farmers State Bank allows our investment professionals the opportunity to develop a strategy that is right for you. Our investment professionals will provide you with an in-depth discussion of your current situation discuss your investment goals and objectives and develop a plan to obtain that goal. Together, a personal investment strategy is prepared for you.

We:

-

Manage the securities in the portfolio, following the strategy guidelines for your portfolio

-

Advise you of all the transactions made in your portfolio.

-

Maintain complete records and provide monthly account reports and year-end tax statements.

-

Provide safekeeping for your securities and collect the income, distributing or reinvesting as you instruct

Custodial Services

For those individuals with the knowledge, confidence, and time to be your own investment manager, our custodial services can be a significant time-saver.

We:

-

Take protective custody of your portfolio and provide safekeeping for the assets

-

Handle the buy and sell transactions through any broker you select

-

Collect your investment income and distributions

-

Maintain securities history and records

Trust Services

Trust Management: Many personal financial objectives extend well beyond those that our investment services cover. A trust can provide the special tool necessary to assist you in meeting your goals such as:

-

Financing your childrens education

-

Supporting an elderly relative

-

Making charitable bequests

-

Reduce estate taxes

-

Managing assets if you are unable to

-

Providing investment management for your family after your death.

Types of trusts include, but are not limited to:

Revocable Living Trust: Provides for asset management by a profession trustee; sets distribution guidelines

Advantages: Flexible, avoids probate cost; provides investment management

Irrevocable Living Trust: Permanently transfers assets out of your estate, much like making a gift transfer

Advantages: Shifts taxable income to those in lower tax brackets; protects assets from creditors

Testamentary Trust: Establishes a trust in a will that takes effect upon ones death.

Advantages: Allows for long term supervision and impartial distribution of assets after ones death

Charitable Remainder Trust: Income from property goes to owner now, but property goes to charity in the future

Advantages: Maintains stream of income for owner (or heirs), yet qualifies for current tax deduction

Charitable Lead Trust: Income from property goes to charity now, but property reverts to owner in future

Advantages: Helps charity sooner, qualifies for tax deduction, but keeps property in the family

Bypass or Generation- Skipping Trust: Provides heirs with income now, but skip their estates at death to benefit younger heirs

Advantages: Reduce estate and other taxes and probate expense by skipping intervening heirs

Estate Settlement Services: Our estate and tax-preparation experience allows us to settle your estate without unnecessary delays and minimizes the tax liability and disruption for your heirs. Farmers State Bank can:

-

Arrange for probate

-

Collect, inventory, value and protect your assets

-

Manage your assets during the administration period

-

Provide accurate records

-

Pay taxes, expenses and debts

-

File income and estate tax returns

-

Distribute assets to beneficiaries

-

Follow directions in your legal documents

Discount Brokerage